The Supply and Demand Engulf

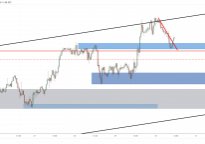

An engulf is simply price action that breaks a significant level. We are interested in engulfs of supply and demand levels to confirm if higher timeframe levels will hold, and to identify possible changes in direction.

This type of price action is particularly useful for those who don't want to touch trade with limit orders straight from supply and demand levels. Waiting for the engulf of opposing levels provides a safer way to trade.

Opposing levels must be completely engulfed, not merely touched. Price must also engulf the level in a strong fashion. Creeping price action that engulfs levels are of no interest to me.

Once an engulf has been identified, you must have a supply or demand level confirming your intended direction in order to trade.

Engulf at Supply

When looking to trade short from supply, a good indication that price will fall is if a demand level is engulfed after the supply level is hit. This adds confluence to the trade.

Engulf at Demand

When looking to trade long from demand, a good indication that price will rally is if a supply level is engulfed after the demand level is hit. This adds confluence for the trade.

Happy Trading

Thank you for another great article!

Thanks for this article! I want to ask you: Why you choose the level after engulf in the first example, but in the second example you chose the level before the engulf. How do you see which of these levels are source of engulf? Thanks, Boby!

Hi Boby. Sometimes the best SD level to trade from will form before the engulf and sometimes it’s after. It all depends really. I should have made that clearer. No two trades will look exactly the same. You just have to trade what you see at the time.

I hope that helps.

Joe

thank you i was about asking the same question

Hi there, great article, though I wanted to ask, do you analyse the daily and execute on the 4hr or 1hr? Furthermore, do you certain number of candles to close above a level to enter?

Hi Ollie, I analyse the daily, and normally execute based on the 5 or 15m. No I don’t watch a certain number of candles around a level.

What do you meant by this “confirm if higher timeframe levels will hold”.

Which engulfing TF is greater, H4 or M30?

Tq.

p/s love your article.

Hi, GabanSama

As I trade with confirmation, I look at price action on a time frame lower than the one that has the main level on it. If my main analysis time frame is the daily, then I’m looking for an engulf on the H1 or someting. If my main analysis time frame is the weekly then I’m looking for confirmation on the daily. With the H1, I’d look at the 5m for confirmation.

Generally higher time frames are king but the engulfing time frame you watch will depend on which your main analysis time frame is.

Hello Joe,

You do not seem to be online most of the time. If you are please contact me. I need your thorough training on supply and demand trading. Thanks

thank you please do you have video in respect to this topic